The following is a success story from Luis on how he was able to buy a house through Overemployment. Note: if ‘OE’ has changed your life, and you’d like to share and inspire others, reach out to Isaac with your story. Without further ado, here’s Luis’s story.

This is a journey on how I leveraged Overemployment to go from sleeping in a friend’s storage room to buying a house in London.

My Humble Beginning

My new life in London started with sleeping in a storage room on an air mattress. Note from Isaac: a tech rite of passage! It was during this time that I discovered the Overemployed community on Reddit, and became motivated to give ‘OE’ a try in order to buy a house.

The COVID tech boom made looking for jobs very easy, especially for the skilled tech professionals. As such, I began my Overemployed journey as a software developer, remotely connecting to a fast growing startup in Silicon Valley.

It turned out this startup’s inexperienced management and lenient company policies (if you could call it that) gave me a golden opportunity to accelerate my personal financial growth. A notable policy was the “unlimited PTO” which, while well-intended, led to me exploiting its nuances for my personal benefit.

Read And Use Your Workplace Policies For Your Own Benefit

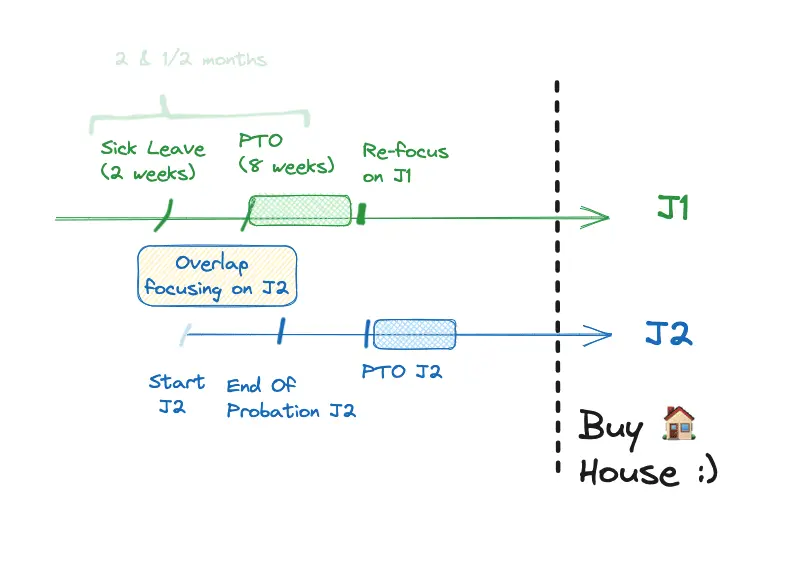

The true game-changer for me was trying out ‘OE’ with a six-month overlap between J1 (job with first company) and J2 (job with second company). In the UK, there is a three-month “probation period” that you must pass to become a permanent employee. This was my target milestone, because after passing the probation period, it’s very hard to get fired. To prepare for this, I didn’t use any of J1’s paid time off (PTO) and kept them for my start at J2.

Before starting J2, I’ve communicated to J1 that I was “going back home” to visit my family in Columbia. Despite being a global company, no one were any wiser on which time-zone I was in and if I was actually worked during the “business” hours on my contract.

Two weeks before J2 starts, I took sick leave from J1 as this was during COVID (oh, thank you so much). After that, I took another two months off from J1 (Isaac’s note: use your HR policies to the fullest extend for time off) to fully focus on J2 and creating a good reputation. My goal was to get pass the probation period J2, which I achieved.

Strategically Time Your Holidays And Time Off Requests

One of the main things I’ve learned while Overemployed is to take time off strategically since time is your most precious resource. Most of my colleagues would take time off during Christmas. This is a terrible strategy as Christmas is the best time to work while no one is around.

I’d advise everyone to “work” during the holidays, leveraging the quiet time to build up a set of finished work (e.g. pull requests) to commit and release slowly come January and February or July and August hits.

During the slow time, I find myself preparing a half-dozen PRs and app features in advance, deploying them bit by bit once everyone is back. It’s also worth nothing that once everyone is back, their inboxes are cluttered – yay, another semi-quiet week goes by. Just when everyone is done catching up, that’s when you take your time off in mid-January or early September.

Isaac’s note: another benefit of this contrarian time-off strategy is you’ll save on flights and hotels since everyone will be back to work! And your colleagues will love you for covering for them during the holidays.

Set Up A Goal (Like Buying A House) and Don’t Look Back

My main goal with Overemployment was to be able to save for a house and never have to pay rent again. Having a clear goal was key in my Overemployed journey since I knew the daily effort will over time translate to a lifetime reward.

Case and point: I went from sleeping on an air-mattress in a storage room to buying a house in one of the most expensive cities in the world, London.

I could now rent the house and move back to Columbia to live a very comfortable life without any financial worries, if that’s what wanted to – the choice is mine to make. That, for me, is called freedom. And in my case, it was achieved through Overemployment.

The ‘OE’ Success Loop: Reflect, Adjust, and Repeat

After achieving my goal of buying a house, I felt I needed to step back from the intensity of juggling two jobs at once. I needed to lower my stress levels and prioritize everyday life again.

Personally, I take work very seriously, so I had to get used to the idea of being an occasionally Overemployed guy. I plan to do two or three jobs to hit a specific goal and then go back down to a single job and “coast” for a few months. Isaac’s note: or not work at all for three months, taking an unpaid sabbatical or personal time off. No one said you’ve to quit your jobs in order to take a break. Explore all the options first.

I believe being intermittently Overemployed is the most sustainable way of building wealth without burning out. I came close to burning out, but thankfully I made it through.

To anyone considering the Overemployed (‘OE’) route, my recommendation is clear: set a clear goal as your exit strategy, hit that goal, and take a break. It offers not just a target but also a sense of accomplishment, ensuring you don’t give up or keep chasing the next dollar (or pound sterling).

Closing Thoughts

My Overemployment experience has equipped me with the knowledge and confidence that I could save $100K a year easily if I put my mind to it. I plan to tap into this strategy cyclically – perhaps every two years. Isaac’s note: think of ‘OE’ as a volume control which you can turn it up or down as it suits your life situation.

My girlfriend and I are considering starting a family in the near future, and the prospect of having a child has made me contemplate re-embarking on the Overemployment journey next year again. The goal? To secure a comfortable future for our child. Isaac’s note: recommend making this a SMART (specific, measurable, actionable, relevant, time-bound) goal for your child, e.g. set aside $250K at the end of the two-year ‘OE’ run for their education or inheritance.

Overemployed is more than just juggling jobs – it’s a mindset change and strategic approach to financial growth. But have a clear vision and an exit strategy of when the party will end. While the path is challenging (as with all good things), you can achieve incredible financial freedom through a little grit and meticulous planning, Just stick with it, and your reward at the end will be substantial.

I am 15 days away of my first year having 2 full time jobs. I realized my job is to keep my jobs. I don’t like and can’t work too many hours, so a lot of work is handling expectations well, being there when things are urgent (I’m an SRE) and having good relationship with peers. Some of my peers know about my situation (at least that I do things on the side, not that there’s another full time job) and they support me with it. Money saving has been amazing.

I recently started OE and saved above 100k in 6 months.

That’s the way! Now invest that $100K in Treasury bonds for a 4-5% return annually, at least as of now. Or spend it on things that really matter to you.

Great story, thanks for sharing.