So you’ve mastered the simplest path to financial freedom by being Overemployed. Time for another wealth secret – the mega backdoor Roth (MBDR). As the top 0.1% of income earners, you need to start thinking like a future mega backdoor Roth millionaire.

In this post, we’ll lay out the simplest path to wealth and save on taxes by becoming a mega backdoor Roth millionaire in ten years or less.

Caveat: future US tax laws may change or close off the MBDR loophole. So don’t delay, get started now.

What’s A Mega Backdoor Roth (MBDR)

Simply put, a mega backdoor Roth is a tax strategy to divert your after-tax dollars into a Roth 401(k) to save on taxes on earnings in perpetuity.

With the mega backdoor Roth, the after-tax money you’ve saved will compound tax-free and withdrawn tax-free once you’re eligible at age 59 ½.

Later, you’ve the option to rollover the Roth 401(k) into a Roth IRA once you leave your employer, or simply leave it in your former employer’s 401(k) plan. The choice is yours.

You can always withdraw your contributions (not earnings) tax and penalty-free from the Roth 401(k) or Roth IRA since taxes were already paid.

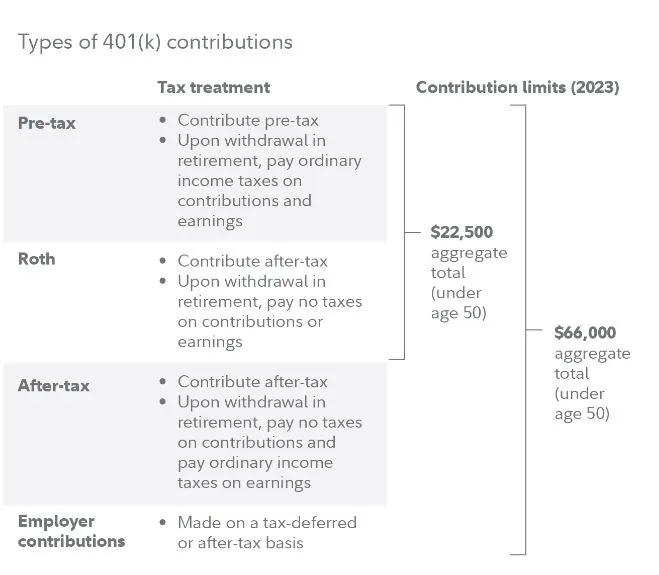

Notes: IRS limits the total amount that can be contributed from you and employer each year. This limit—known as the 415(c) limit—is $66,000 for 2023 or $73,500 if you’re age 50 or older by the end of the calendar year. This amount includes your pre-tax and Roth 401(k) contributions, employer matching contributions, and your after-tax contributions.

$66,000 = Pre-tax 401(k) contributions + Roth 401(k) contributions + employer matching + after-tax contributions

OR,

After-tax contributions = $66,000 – Pre-tax 401(k) contributions + Roth 401(k) contributions + employer matching

Pre-tax 401(k) + Roth 401(k) contributions together is regarded as your employee elective contributions, limited to $22,500 in aggregate across all 401(k) plans. Or, put another way, this limit is universal on a per individual basis. This limited is NOT to be confused with the 415(c) limit of $66,000 total contributions per employer AND employee together.

In short, the mega backdoor Roth is taking advantage of the higher 415(c) limit to “backdoor” more savings into the Roth 401(k) via after-tax contributions and save on future taxes.

If you’re sold on the idea, skip ahead to how to get started with the mega backdoor Roth. Otherwise, read on for more details.

What is “Mega” About This Tax Strategy

The reason why this tax strategy is called “mega” is best illustrated below.

Notice your IRS-allowed after-tax contribution will vary as you’ll need to figure out your employer match and elective contributions you plan on making first per employer’s 401(k) plan.

Once you’ve these numbers, subtract them from the total contribution limit of $66,000 per employer. Learn more about how to maximize 401(k) employer match and how the 401(k) elective employee contribution limit works.

Using the 80/20 rule, we estimate an average two-job Overemployee will be able to save $70,000 to $80,000 in backdoored Roth 401(k) across both employers per year, subject to each employer’s 401(k) plan contribution limitations.

This is an absurd amount of money sheltered in tax-advantaged accounts each year folks! And you’ll never have to pay taxes on the earnings. The numbers get even crazier with 3Js with over $100,000 saved each year. This is the hidden financial-boosting power of the Overemployed – by becoming a mega backdoor Roth millionaire sooner than later.

Note: DO NOT exceed the max $66,000 limit per employer for 2023 or you’ll have to make an excessive contribution withdrawal when you file taxes. This is a tax headache you’ll want to avoid so you can enjoy spring break with the kids.

What is “Backdoor” About This Tax Strategy

This strategy is often referred to as a backdoor since you’ll bypass making contributions directly into your employer’s Roth 401(k) as part of your $22,500 employee elective contribution limit.

Instead, you’ll take advantage of the much larger after-tax contribution amount and set up an automatic in-plan conversion to move your money from after-tax to Roth 401(k) automatically every time you make a contribution – hence the backdoor reference.

More to follow on this very important step of setting up the automatic in-plan conversion in order avoiding a tax headache later on.

Note: technically the mega backdoor Roth is a double-backdoor, first from after-tax 401(k) to Roth 401(k), and then from Roth 401(k) to Roth IRA. The Roth IRA has an income limit on contribution, which can be bypassed through a “mini” or backdoor Roth IRA. But the contribution limit is only $6,500 per individual.

All in all, “mega” is better than “mini” backdoor when you compare contributions of ~$40,000 per employer versus $6,500 only for yourself given the same tax treatment. Better yet, if you’ve enough income, you can do both “mega” and “mini” backdoor Roth. Cha-ching!

Reminder: you’ll want to spread your $22,500 employee elective contribution limit across all your employers to capture all employer matching since this limit is universal – meaning the limit applies to each individual/social security number across all employers. This information is reported to the IRS through your W-2 tax form so don’t try to get cute.

Why Not Just Put After-Tax Money Into A Taxable Brokerage Account

Here’s what you need to know – you’re paying the taxes on your gross income up front either way, the decision is on whether you should put your after-tax dollars into the Roth 401(k) via a loophole or put them into a general taxable brokerage account like everybody else.

Our short answer is if you can wait until age 59 ½, then the mega backdoor Roth is the optimal decision since your earnings will accrue and compound tax free in perpetuity.

However, if you need the money sooner, then putting your after-tax dollars into a general taxable brokerage account is a reasonable option, knowing that you’ll owe taxes every year on interests and capital gains. Again, before making a rash decision based on future cash needs, note that all contributions into a Roth 401(k) are withdrawable tax and penalty-free. You can also borrow from up to $50,000 from your Roth 401(k) in a cash crunch.

Here’s the ultimate tax-savings bonus: if you follow our mega backdoor Roth millionaire strategy, by the time you’re 59 ½, and depending on life circumstances, you’ve the option to reduce your taxable income by covering your living expenses with your Roth after-tax income alone. Remember qualified Roth withdrawals (after 59 ½) are always tax-free.

Heck, if your taxable income is low enough, e.g. you don’t work or delay drawing down your pre-tax 401(k) or traditional IRA, you might even qualify for additional tax deductions and credits.

And if your taxable income is very low, you might even qualify for federal assistance programs, lowering your expenses even further. Now that’s a win-win-win strategy.

So say goodbye to the Roth conversion ladder – a strategy to withdraw from your 401(k) in early retirement by converting pre-tax 401(k) to Roth IRA, pay ordinary income taxes on the conversion, and withdraw the conversion from Roth to pay for expenses – and hello to the mega backdoor Roth millionaire strategy. STOP PAYING TAXES when you don’t have to.

How To Get Started With The Mega Backdoor Roth (MBDR)

In order to get started with MBDR, you’ll need the following:

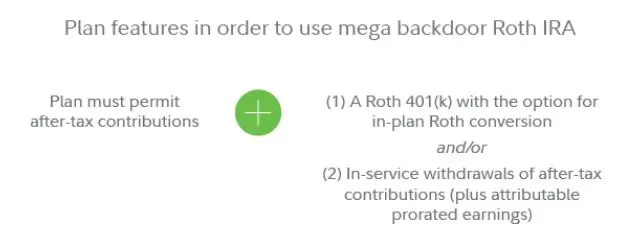

- Verify with your 401(k) plan administrator, e.g. Fidelity, Schwab, Vanguard, etc. that your company’s plan allows for after-tax contribution.

- IMPORTANT: Call your plan administrator to set up your “after-tax automatic in-plan conversion to Roth 401(k).” Use this verbiage exactly. Most plan administrators have to set this up manually in their system. So if you cannot find this feature online after logging in, it’s best to call.

- After automatic in-plan conversion is confirmed by the plan administrator that it has been set up, calculate how much you can contribute in after-tax without violating the IRS limit of $66,000 total contribution per employer.

- After you’ve calculated a set percentage of your salary that gets close to $66,000 and not over it, start making after-tax contributions in your company’s 401(k) plan.

- Review your statements and verify that the after-tax contributions are indeed inside your Roth 401(k) after your next pay period.

- Repeat steps 1 to 3 for your J2 employer’s 401(k) plan.

To review, below is an illustration of what’s required to start you mega backdoor Roth millionaire journey:

Note: not all employers offer an after-tax component in their 401(k) plan and/or an automatic after-tax to Roth in-plan conversion. Without the automatic conversion, we don’t advise doing a mega backdoor Roth strategy since you’ll face some tax complications.

IMPORTANT tax caveat: if you did not set up automatic conversion and left money in the after-tax 401(k), then any earnings on the after-tax contributions are considered taxable. And if you later convert your after-tax 401(k) to a Roth 401(k), you’ll now have a mixed taxable and non-taxable pot of money and the tax headache of sorting out what’s taxable and what’s not.

As an Overemployed, life is complicated enough, make sure you are set up on the automatic in-plan conversion before executing on the mega backdoor Roth millionaire strategy.

Why Aren’t More People Doing the Mega Backdoor Roth (MBDR)

Quite simply, most people don’t earn enough to cover their monthly expenses to afford socking away more after-tax dollars into a tax-advantaged account.

But because you’re now Overemployed and at least doubling your income, you can afford to dedicate your second income to paying off debt and save aggressively to become a mega backdoor Roth millionaire – saving a ton of future taxes along the way.

Our general rule of thumb is you should have no debt other than your primary home mortgage before considering locking your money up in the mega backdoor Roth.

Chances are, after a couple of years being Overemployed, you’re in a position to start taking the next big leap in becoming a mega backdoor Roth millionaire.

Bonus Tip #1: Only make 401(k) contributions off base salary

Here’s why – the $66,000 total contribution limit per employer. You want to come close to the limit but not exceed it. Therefore, it’s more predictable to make after-tax contributions as a percentage of base salary than with one-time bonuses since the latter are variable and less predictable.

Also, there’s a small chance that you might have miscalculated your employer match amount and your elective employee contribution. So leave yourself some margin of error by only contributing all your 401(k) off your base salary alone.

Lastly, mark your calendar mid-year to check in on your contributions across all employers and make any necessary adjustments so you don’t cross the $66,000 total contribution limit per employer.

Just don’t mess with the IRS.

Bonus Tip #2: If you have a small business or 1099 income, consider contributing to a solo 401(k)

For a high income earner who happens to also be self-employed or have a side hustle, then you can lower your tax liabilities further by contributing to a pre-tax solo 401(k) – this is an instant tax savings of 37% on federal taxes and “x” percent off your state and local taxes if you’ve them.

Remember to make employer contributions, NOT employee elective contributions since the latter is limited to $22,500 in 2023 across all employers. For the self-employed, you’re both the employer and the employee.

Note: your employer contribution is limited to 25% of net profit on your Schedule C. Please refer to IRS publication 560 starting from the IRS page on retirement plans for the self-employed.

You also might be asking why not contribute to a SEP-IRA or the Roth solo 401(k). We’ll cover the solo 401(k) more in detail in a following post and how it complements our mega backdoor Roth millionaire strategy. Hint: it has to do with rollovers, portability, and simplicity of managing your future millionaire dollar Roth accounts.

Fun Fact: Aim Higher, Be A Roth Billionaire Like Peter Thiel

Believe it or not, there’s always another person richer than you, just check out how Peter Thiel amassed $5 billion in Roth IRA through self-directed IRA investing as a venture capitalist. Don’t try this folks. But hey, at least we can settle for being merely Roth millionaires instead.

Indexed universal life is far better. You earn tax-free, can access your money any time tax-free and without penalty and can put in as much as you like at any time – not limited amounts in a given year. And when you die, your investment “blossoms’ for your heirs and they inherit tax-free. And you still average ten percent per year without the downside risk that you have if you invest directly in the stock market. For these reasons, Doug Andrew has never had a roth and never will. He has an educational YTchannel if you care to investigate.

Thank you I’ll have to look into this!

I looked over this very quickly & not in too much detail, but what I will say a few things that people need to beware of if my experience with this is correct.

First off many employers do offer Roth 401K’s, but some do, and it is becoming more prevalent. You as the employee can contribute to your portion of the Roth 401K up to the contribution limit. However, unless something has changed, your employers “match” so to speak is not like the Roth contribution, but more like the traditional contribution. I may be wrong but I do not believe the employer has the option to contribute their match as a Roth version. The employer match has to be in the traditional sense. Your contribution as an employee can be the Roth part of the 401K, if your employer offers one.

Second, when it comes to employer matches there is the Vesting rules. As an employee if you are not fully 100% vested & you leave the company, your employer can pull your matching contribution away from you. It’s not your money until you are fully vested. This within itself can make things even more complicated.

Third, if your income is too high to directly contribute to a Roth IRA, you can try & contribute to a Traditional IRA & perhaps a few weeks after convert your traditional IRA contribution into a Roth contribution. By doing so you pay no tax on the conversation. However, if there are any earnings within that few week timeframe, and/or you have previous Traditional IRA’s, not only do you pay tax on the earnings for that few week timeframe, you also pay tax based upon a percentage of the value of those previously contributed traditional IRA’s you have out there. IRS has a formula to determine how much of those prior tradition IRA ‘s you have will make any or part of your current conversion taxable.

IRS is not a fan of the backdoor Roth & there are many complicated rules on these conversations.

In my personal opinion, these backdoor Roth IRA’s should not be allowed in the first place. Be honest. You make enough money, and should be forced to pay the taxes. Greed is not the answer.

And finally, I agree with you on the Solo 401K for Schedule C Self Employed Individuals, but only if they truly utilize making the contributions every year. If not, why waste the money on administrative fees to keep it open.

Nothing is never one size fits all. It’s almost as bad as when a lawyer or CPA creates a single member S-Corp when that business really isn’t making much money.

It just doesn’t make sense.

Bottom line is everything is situational with taxes & things change from year to year.

Mega backdoor Roth is NOT the same and directly contributing to your Roth 401(k) via elective employee contributions.

Thank you for posting this, I was unaware I was so close to the $66k limit for J2. I’m pretty sure I have the dream retirement investment scenario, at least for someone with only two J’s.

Here is my 2023 plan:

J1: Maxing out 403b, $22,500, plus 10% employer match $9,242. TOTAL: $31,742

(Had an HSA for J1 before, but had to change plans for 2023 until I knew my health ins situation with J2. J2 allowed me to turn down health ins, so I’ll get an HSA at J1 again in 2024)

J2: Mandatory 401a, 7% employee contribution $6,020, 8% employer contribution $6,880, because it’s mandatory, I can make an after tax contribution and then roll it over into a personal Roth IRA. I’m on pace for another $27,750.

Another $22,500 into a 457b.

The tax deferrals from the 403b and 457b drops my MAGI below $138,000, so I also max out a personal Roth IRA.

Total retirement contributions for 2023: $101,392

Thanks Tom Cruise, you’re a lucky boy indeed. Just make sure the employee elective contribution limit is NOT a combined limit for 403b and 401a, as it’s the case for two different 401Ks.

Is there an advantage of contributing 22.5k pretax dollars and then contributing the remaining to after tax 38.5k? Or should you just contribute all 66k to after tax

Most (if not all) employers only do matching on the $22,500 portion, usually capped at a maximum absolute number, e.g. 4% dollar-for-dollar up to “x” amount per year. So yes, if you’re at the marginal federal tax bracket of 35 or 37%, then definitely do pre-tax (instant tax savings since this is deducted off your gross income) and capture the employer match before doing the after-tax contributions.

There is an implied notion that the magic of compounding (market return over time) is greater than the cost of the strategy (paying tax at likely your highest tax rate), right?

You’re almost there. Forget compounding market return for a bit — that’ll happen either way no matter where you invest your savings.

The decision is what to do after you PAID taxes on your gross income net of all other tax-deferred strategies like contribution to pre-tax 401(k), HSA, etc.

Do you put the after-tax money into a taxable investment account or do you put it into a Roth 401(k) indirectly through the after-tax 401(k), sheltering the money from future taxes?

Another word, if you think incrementally, the compounded tax savings for sheltering your after-tax dollars in a Roth 401(k) instead of a general taxable account is HUGE in perpetuity, not the mention the other ancillary benefits of having an artificially lower taxable income later once you are eligible to withdraw from the Roth to cover your expenses tax-free.

Just to be clear, this article is wrong. The annual 401k cap is not per employer. It’s a total aggregate of employee and employee/employer contributions across all employers.

Don’t be misinformed. Double check everything you read on the internet.

So say another random person on the internet LOL without referencing any other facts. Your statement is only true for elective deferrals (employee contribution) which are universal across all employers per the individual.

When in doubt, read the source documents: https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-401k-and-profit-sharing-plan-contribution-limits

Overall limit on contributions

Total annual contributions (annual additions) to all of your accounts in plans maintained by one employer (and any related employer) are limited. The limit applies to the total of:

elective deferrals (but not catch-up contributions)

employer matching contributions

employer nonelective contributions

allocations of forfeitures

The annual additions paid to a participant’s account cannot exceed the lesser of:

100% of the participant’s compensation, or

$66,000 ($73,500 including catch-up contributions) for 2023; $61,000 ($67,500 including catch-up contributions) for 2022; $58,000 ($64,500 including catch-up contributions) for 2021; and $57,000 ($63,500 including catch-up contributions).

Can you recommend financial advisor who can do that for me or set it up .

Just follow the how-to-steps laid out in the post. Or, if you really prefer someone to help you, you can sign up for our coaching help.